Living in Monaco offers a distinct privilege: freedom from personal income tax. However, freedom from tax does not mean freedom from paperwork.

For business owners, VAT filers, and foreign nationals (particularly French and American citizens), 2026 brings a strict schedule of compliance deadlines. Furthermore, January 1, 2026, marks the implementation of new European transparency rules (DAC8) regarding crypto-assets and cross-border reporting, making timely filing more critical than ever.

Whether you run a SARL in Fontvieille or manage a family office in Monte Carlo, missing a deadline can trigger audits and penalties.

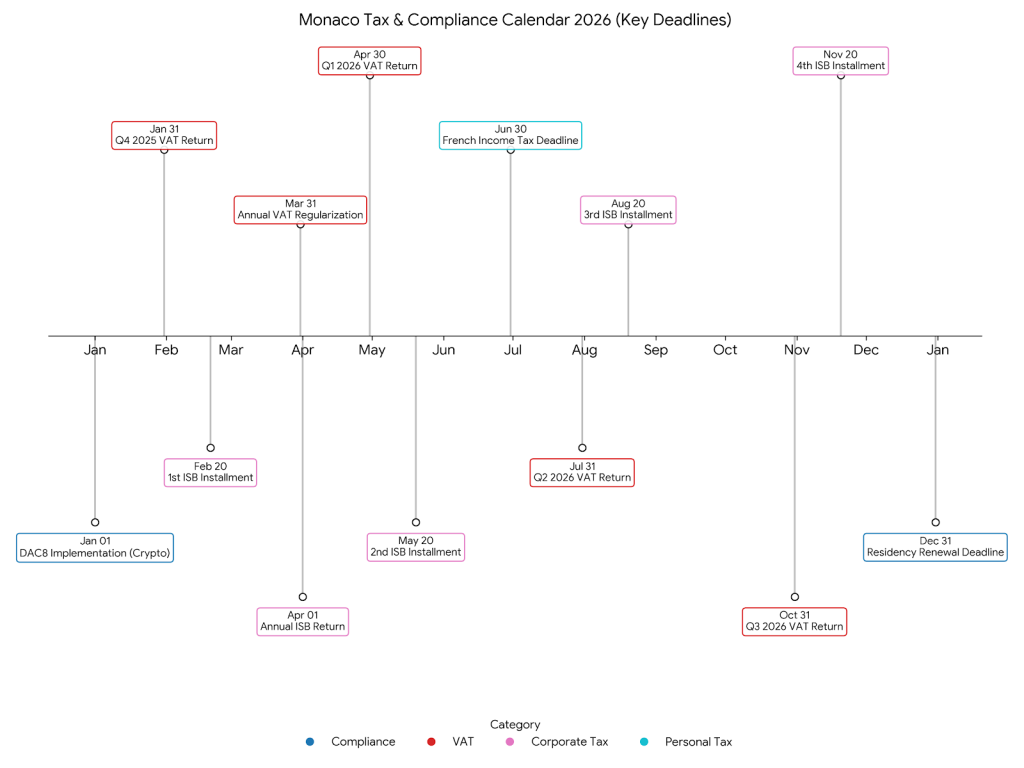

Here is your definitive tax and compliance calendar for the 2026 fiscal year.

The 2026 Compliance Calendar: At a Glance

Note: Dates falling on weekends typically move to the next business day.

Q1 2026: The Start of the Fiscal Year

- January 1: Implementation of DAC8 (Directive on Administrative Cooperation). Monaco financial institutions begin stricter reporting on crypto-asset transactions to EU member states.

- January 31: Deadline for the 4th Quarter 2025 VAT Return (for quarterly filers).

- February 20: 1st Installment of Corporate Income Tax (ISB). Calculated as 20% of the previous year’s tax liability.

- March 31: Deadline for submitting the Annual VAT Regularization for 2025.

Q2 2026: Major Filing Season

- April 1: Deadline for Annual Corporate Tax Return (ISB) for companies with a fiscal year ending December 31, 2025.

- April 30: Deadline for 1st Quarter 2026 VAT Return (quarterly filers).

- May 20: 2nd Installment of Corporate Income Tax (ISB).

- June 30: Standard deadline for French Nationals in Monaco to file their French income tax declarations (dates vary slightly by department).

Q3 2026: Summer Compliance

- July 31: Deadline for 2nd Quarter 2026 VAT Return (quarterly filers).

- August 20: 3rd Installment of Corporate Income Tax (ISB).

Q4 2026: Year-End Planning

- October 31: Deadline for 3rd Quarter 2026 VAT Return (quarterly filers).

- November 20: 4th Installment of Corporate Income Tax (ISB).

- December 31: Deadline for renewing Residency Cards expiring in 2026 (must be initiated before expiration).

Save this 2026 Compliance Calendar:

Detailed Breakdown: Business Taxes (ISB & VAT)

While individuals pay 0%, companies in Monaco face a more complex reality.

Corporate Income Tax (ISB) in 2026

If your business generates more than 25% of its turnover outside of Monaco, you are subject to the Impôt sur les Bénéfices (ISB).

- The Rate: The standard rate for 2026 remains 25%.

- The Installment System: You do not pay in one lump sum. You must pay four provisional installments (Feb, May, Aug, Nov). Each payment should equal 20% of the tax paid for the previous fiscal year.

- The Final Settlement: When you file your annual return (usually by April 1st), you calculate the total tax due. If your installments covered less than the total, you pay the balance immediately. If you overpaid, you receive a credit.

Value Added Tax (TVA)

Monaco sits within the French VAT zone. The standard rate is 20%.

- Monthly Filers: Required if your annual VAT liability exceeds €4,000. Returns are due by the 21st of the following month.

- Quarterly Filers: Permitted if annual VAT liability is under €4,000.

- The “DAC8” Impact: Starting in 2026, companies dealing in crypto-assets or e-money must be meticulous with their VAT records, as automated data sharing with EU tax authorities increases under the new Directive on Administrative Cooperation.

Residency Renewal Deadlines

For most residents, the most “taxing” event of the year is the renewal of the Carte de Résident. This is not a financial tax, but a “time tax.”

- The Rule: You must apply for renewal between 2 months and 1 month before your current card expires.

- The 2026 Change: The government is pushing heavily for online renewals via the MonGuichet.mc portal. Paper applications are becoming the exception.

- Late Renewal Penalty: If you apply after your card has expired, you may face fines or, in severe cases, a revocation of residency.

- Required Documents: You will need to prove you still meet the Conditions for Obtaining Residency, including a fresh bank attestation and a current lease or utility bill.

Special Categories: French & US Nationals

The “0% Tax” rule has two major exceptions.

French Nationals (The 1963 Treaty)

French citizens living in Monaco are generally treated as if they lived in France for tax purposes.

- Deadlines: You follow the French tax calendar. Income tax declarations are typically due in May or June 2026 (online).

- Property Tax: If you own property in France, beware of the 2026 property tax updates across the border, which may include base re-evaluations.

US Citizens

You are taxed on your worldwide income by the IRS, regardless of where you live.

- April 15, 2026: Standard filing deadline.

- June 15, 2026: Automatic extension deadline for expats living abroad.

- October 15, 2026: Final deadline if you requested an extension.

- FBAR Deadline: Don’t forget to report your Monaco bank accounts (FinCEN Form 114) by April 15 (with an automatic extension to October).

FAQ: Monaco Tax 2026

Q: Is there a property tax in Monaco for 2026?

A: No. There is no annual property tax (taxe foncière) in Monaco for real estate owners. You only pay ownership costs like building charges.

Q: What happens if I miss an ISB installment deadline?

A: Late payments incur interest penalties, typically around 1% per month of delay. It is crucial to set up automated reminders.

Q: Do I need to declare my crypto assets in Monaco in 2026?

A: While Monaco has no capital gains tax on crypto for individuals, the new DAC8 rules mean that exchanges and custodians will report your holdings to tax authorities in your country of citizenship (e.g., if you are French or German). Privacy is significantly reduced starting Jan 1, 2026.

Q: I just moved to Monaco. When do I become a tax resident?

A: You are considered a tax resident from the day your residency permit is issued. However, to maintain this status, you must spend 183 days in the Principality in 2026. Keep a travel diary or flight logs in case of an audit.

Need to set up your base of operations? Explore our guide on Buying Property in Monaco or compare the Tax Benefits of Owning Property vs. other jurisdictions.