The decision to move to Monaco is rarely taken lightly. It is a lifestyle choice, a financial strategy, and often a significant life change. Once the decision to move to the Principality is made, the next immediate hurdle appears. Should you buy a property, or should you rent?

In most cities around the world, this question comes down to simple mathematics. You compare monthly mortgage payments against monthly rent and factor in potential appreciation.

Monaco is not most cities.

The real estate market here operates under a unique set of pressures driven by extreme scarcity, immense global demand, and specific rules tied to residency. A decision that might make financial sense in London or New York might be the wrong strategic move in Monte Carlo.

This guide is designed to walk prospective residents and investors through the nuances of the “Buy vs Rent” dilemma in Monaco as we head into 2026. We will look beyond just the price tag to consider stability, capital demands, and the all-important requirement of establishing residency.

The Unique Context of the Monaco Market

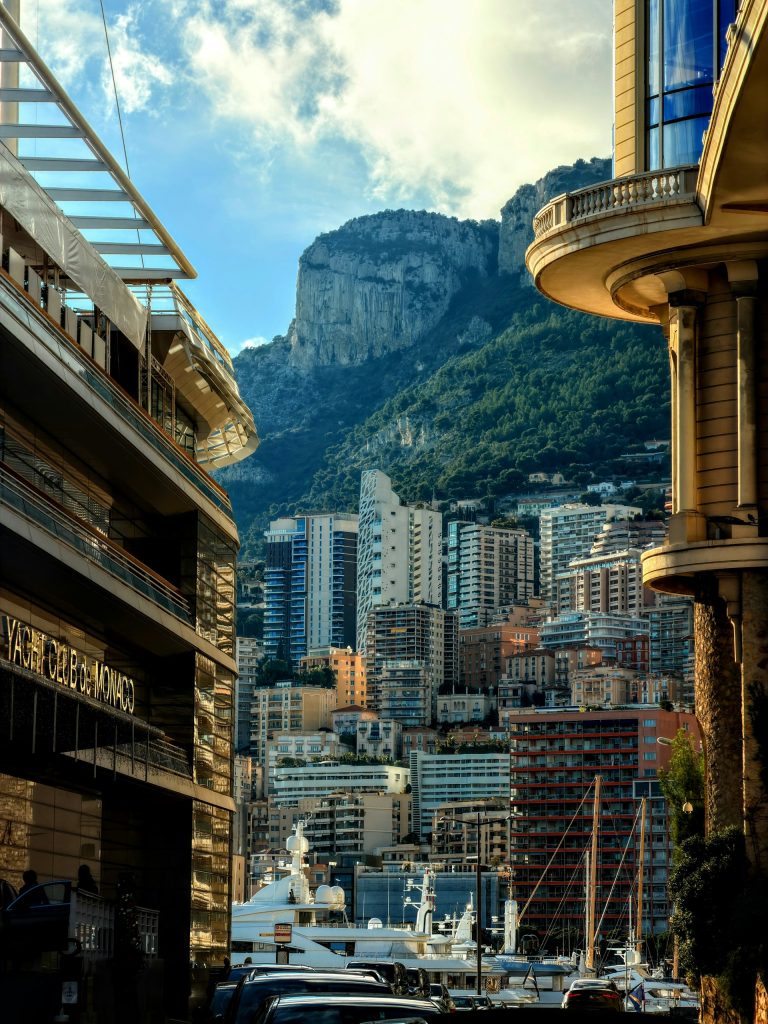

Before diving into the pros and cons, it is vital to understand the playing field. Monaco is approximately two square kilometers in size. The demand for space within this tiny border is relentless.

This creates the world’s most expensive real estate market. When prices per square meter regularly exceed €50,000, the capital required to purchase even a modest apartment is substantial.

Furthermore, the rental market is equally competitive. The stock of available rental properties is limited, and high-quality units in desirable districts do not stay on the market for long.

Perhaps the most critical factor separating Monaco from other markets is the direct link between housing and your legal status in the country. To obtain a residency card, you must prove you have “appropriate” accommodation. This adds a layer of bureaucratic necessity to your housing decision.

The Case for Buying in Monaco

For many moving to the Principality, buying a property is the ultimate goal. It represents a permanent foothold in an exclusive enclave.

The Pros of Buying

1. Long-Term Capital Appreciation

Historically, Monaco real estate has been an exceptional store of wealth. Despite global economic fluctuations, property prices in the Principality have shown a remarkable, consistent upward trajectory over the decades. Finite supply means that as long as global wealth continues to grow, demand for Monaco will likely outstrip supply. Buying is a bet on the continued desirability of the Principality.

2. Security and Stability

Owning your home removes the uncertainty of the rental market. You do not have to worry about landlords reclaiming the property or escalating rents at the end of a lease term. For families looking to put down roots and enroll children in local schools, this stability is invaluable.

3. The Ultimate Proof for Residency

While you can obtain residency by renting, owning property is viewed very favorably by the authorities. Presenting a notarized ownership deed is the most definitive way to satisfy the accommodation requirement for your residency application. For more on this process, read our guide on the Conditions for Obtaining Residency in Monaco.

4. Freedom to Renovate

The housing stock in Monaco is varied. Many older “Bourgeois” buildings offer incredible potential but require modernization. Owning a property gives you the freedom to renovate it to your exact standards, potentially adding significant value in the process.

The Cons of Buying

1. Massive Capital Tie-Up

This is the biggest hurdle. Buying in Monaco requires tying up a significant amount of liquidity. Even a small one-bedroom apartment can cost several million euros. You must consider the opportunity cost of that capital. Could it generate better returns elsewhere?

2. High Transaction Costs

Entering the market is expensive. Between notary fees, registration duties, and agency fees, you should budget for transaction costs amounting to roughly 6% of the purchase price. These are sunk costs that you do not get back. For a detailed breakdown, see our article on The Hidden Costs of Buying Real Estate in Monaco.

3. Illiquidity

While demand is high, real estate is inherently an illiquid asset. Selling a multimillion-euro property takes time. If you need to access your cash quickly, a property in Monaco is not the right vehicle.

The Case for Renting in Monaco

Renting in Monaco is far more than just a stop-gap solution. For a large percentage of residents, it is a strategic long-term choice.

The Pros of Renting

1. Flexibility and Speed

Renting is significantly faster than buying. You can identify a property, sign a lease, and move in within a matter of weeks. This is ideal for those who need to establish residency quickly. It also offers the flexibility to move easily if your needs change or if you decide you prefer a different neighborhood, like moving from the buzz of La Condamine to the quiet of Fontvieille.

2. Lower Capital Requirement

While rents are high, the upfront capital required is a fraction of buying. Typically, you will need to put down a deposit equivalent to three months’ rent, plus pay three months’ rent in advance, along with agency fees. This keeps the bulk of your capital free for other investments or business activities.

3. “Try Before You Buy”

Monaco is unique, and its districts are distinct. Renting allows you to test the lifestyle before committing millions to a purchase. You might find that the glamour of Monte Carlo is too noisy for daily life and that you prefer a different area.

4. The Yield Anomaly

This is a crucial financial point. Rental yields in Monaco are very low, often between 1.5% and 2.5%. This means that relative to the enormous cost of buying a property, the cost of renting it is actually quite low. Financially astute residents often realize it is cheaper to rent a €10 million apartment than to buy it, especially when they can invest that €10 million elsewhere for a higher return. You can learn more about this in our deep dive on All you need to know about rental yields in Monaco.

The Cons of Renting

1. Dead Money

The psychological hurdle of renting is that your monthly payments are building someone else’s equity, not your own. In a high-rent market like Monaco, this is a significant annual expenditure with no retained value.

2. Lack of Security

Standard leases in Monaco are often for one year. While many are renewed, there is no guarantee. A landlord may decide to sell the property or move a family member in, forcing you to find a new home and go through the moving process again.

3. Rent Increases & Competition

The rental market is fierce. When a good property comes up, there are often multiple takers. Furthermore, rents can increase upon lease renewal, adding uncertainty to your long-term budgeting.

The Residency Factor

It is impossible to discuss buy vs rent without mentioning residency.

As mentioned, the government requires proof of “appropriate” accommodation to issue a residence card.

- If you buy: You provide your ownership deed.

- If you rent: You provide a registered lease for a minimum of one year.

Both are perfectly acceptable to the authorities. However, the property must be suitable for the size of your household. A family of four cannot rent a small studio just to get a paperwork address; the authorities will reject the application.

For those testing the waters, renting a compliant apartment for the first year is a very common strategy. It allows you to secure your residency card and then take your time searching for a property to buy without time pressure.

Conclusion: Which Strategy is Right for You?

There is no single answer to the buy vs rent dilemma in Monaco. The right choice depends entirely on your personal financial situation, your timeline, and your goals.

You should consider buying if:

- You are committed to Monaco as your long-term home.

- You have significant liquidity and are looking for a safe, defensive asset for wealth preservation.

- You want total control over your living environment and stability for your family.

- You are buying as a generational investment to pass down to heirs.

You should consider renting if:

- You are new to Monaco and want to experience the lifestyle before committing.

- You want to establish residency quickly with a lower upfront cost.

- You can generate significantly higher returns on your capital elsewhere than the capital appreciation of Monaco property.

- You value flexibility and may only reside in the Principality for a few years.

Ultimately, many residents end up doing both. They rent initially to secure their status and learn the market, then eventually purchase a home once they find the perfect fit. In the high-stakes world of Monaco real estate, patience and a clear strategy are your best assets.

At a Glance: Buying vs. Renting in Monaco (2026 Comparison)

| Feature | Buying a Property | Renting a Property |

| Upfront Capital | Very High: 100% of price (or 40-50% deposit + mortgage) + ~6% transaction fees. | Moderate: 3 months rent (deposit) + 3 months rent (advance) + Agency fees (10% of annual rent + VAT). |

| Transaction Costs | ~6% Sunk Cost: (4.5% Transfer Tax + 1.5% Notary Fees). New builds have 20% VAT (usually included in price). | Agency Fees: Typically 10% of the first year’s rent + 20% VAT. Registration duty of 1% of annual rent. |

| Annual Holding Costs | Low: Building service charges + Insurance. No annual property tax. | High: Monthly rent payments (often €6,000 – €15,000+ for family units) + Building charges. |

| Residency Impact | Strongest Proof: Ownership deed is the “gold standard” for the Sûreté Publique. | Fully Valid: A registered lease (min. 1 year) is accepted. Must meet “appropriate size” rules (e.g., no studios for families). |

| Financial Return | Capital Appreciation: Historically steady growth (~44% over 10 years). Wealth preservation asset. | Yield Arbitrage: You keep your capital liquid to invest elsewhere for higher returns (since rental yields are low, <2.5%). |

| Flexibility | Low: Illiquid asset. Selling takes time (months/years) and incurs exit fees. | High: 1-year standard leases allow you to move districts easily or upgrade as needed. |

| Risk Profile | Market Risk: Exposure to global real estate cycles, though Monaco is low-volatility. | Tenant Risk: Rent increases (market rent can jump 10-15% on renewal) or non-renewal of lease. |

| Best For… | Long-term residents (5+ years), families seeking stability, and generational wealth planning. | Newcomers “testing” the lifestyle, entrepreneurs needing liquidity, and short-term residents (<3 years). |

FAQ: Buying vs Renting in Monaco

Q: Is it cheaper to buy or rent in Monaco monthly?

A: Generally, your monthly outgoings will be lower if you rent. Because purchase prices are so high, the equivalent mortgage payments on a property would usually far exceed the monthly rent for the same unit. This is due to the very low rental yields in the Principality.

Q: Can I get residency if I only rent?

A: Yes, absolutely. A registered lease for a minimum duration of one year for a property of appropriate size for your household is fully sufficient to satisfy the accommodation requirement for a residency application.

Q: Are there annual property taxes in Monaco if I buy?

A: No. One of the major benefits of buying is that there is no annual property tax (taxe foncière) in Monaco. Once you have paid the initial transaction costs, your holding costs are restricted to building service charges and insurance.

Q: How quickly can I find a rental property in Monaco?

A: The market moves fast. If you are decisive and have your paperwork ready, you can identify a property, sign a lease, and transfer funds within a few weeks. Buying takes considerably longer, usually between two and three months from offer to completion.